HAMILTON, Bermuda (BUSINESS WIRE) - November 16, 2007. Textainer Group Holdings Limited (NYSE: TGH) (“Textainer” or the “Company”), the world’s largest lessor of intermodal containers based on fleet size, today reported results for the third quarter and the nine months ended September 30, 2007.

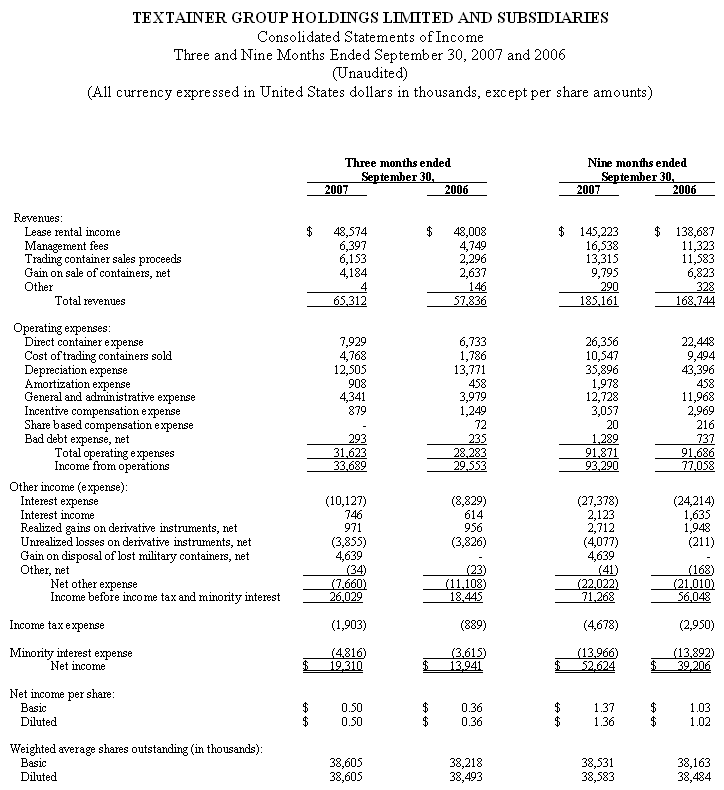

Total revenues for the quarter increased by $7.5 million, or 13%, to $65.3 million compared to $57.8 million in the prior year quarter. EBITDA (1) for the quarter increased by $7.9 million, or 18%, to $51.7 million compared to $43.8 million in the prior year quarter.

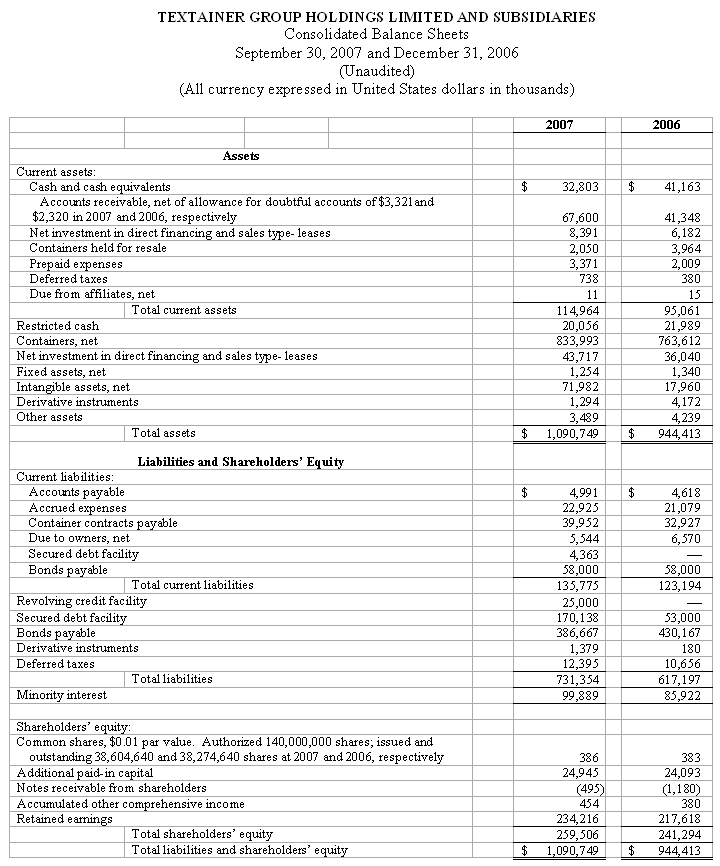

Net income for the quarter was $19.3 million, an increase of $5.4 million, or 39%, compared to $13.9 million in the prior year quarter. Textainer’s net income per fully diluted common share increased by $0.14, or 39%, to $0.50 from $0.36 in the prior year quarter. Textainer recognized a gain on disposal of $4.6 million in the quarter due to the reported loss by the U.S. military of approximately 28,000 containers that were on lease to them and unaccounted for. This is not expected to be a recurring item.

Total revenues for the first nine months of 2007 increased by $16.4 million, or 10%, to $185.2 million compared to $168.7 million for the same period last year. EBITDA (1) for the first nine months increased by $15.0 million, or 12%, to $135.8 million compared to $120.7 million in the same period last year.

Net income for the first nine months of 2007 was $52.6 million, an increase of $13.4 million, or 34%, compared to $39.2 million for the same period last year. Textainer’s net income per fully diluted common share increased by $0.34, or 33%, to $1.36 compared to $1.02 share for the same period last year.

“I am very pleased with our 2007 third quarter and year-to-date results. Overall demand for our containers through September was very strong, with Asia-Europe trade growth offsetting weaker Asia-North America trade. Textainer’s utilization continued to remain above 94%, including the addition of the Capital Lease fleet”, commented John A. Maccarone, President and CEO of Textainer.

He continued “Our container resale segment had the best quarter in its history. After only three quarters, resale income before taxes already exceeds last year’s record results. We are also on track to purchase more than the 132,600 TEU of new containers we have already ordered”.

“For us, the major event in the third quarter was our purchase of the management rights to the 500,000 TEU fleet of Capital Lease, a competitor. The contracts were signed on July 23, 2007, and we were able to integrate the entire Capital Lease fleet and assume management effective September 1, 2007. A lot of credit must be given to the IT, Sales/Marketing, Operations, and Billing departments for getting this done, and done properly, in just over a month. Textainer now operates a fleet of more than 2 million TEU”.

Outlook

Mr. Maccarone added, “After a slowdown in October due to the week of National Holidays in China, we expect November and December to be quite strong. The initial outlook for 2008 is somewhat uncertain due to forecasts of lower GDP growth in many countries. There is also uncertainty about freight rates due to the large number of new vessels entering service next year. If freight rates decline, and liner profitability weakens, there is a good chance our customers may decide to lease a larger portion of their total container requirements. 2007 is already our second largest year in terms of originating Long Term leases, with a good possibility it could become our largest year in terms of originating Long Term leases if the strong bookings continue throughout the fourth quarter of 2007”.

“We are also having an excellent year in our Resale Division, both in terms of prices realized, and volume of containers sold. In general, all phases of our business are working very well”.

Dividend

Textainer’s board of directors has approved and declared a quarterly cash dividend of $0.20 per share on Textainer’s issued and outstanding common shares, payable on December 3, 2007 to shareholders of record as of November 26, 2007.

Investors’ Webcast

Textainer will hold a conference call and a Webcast at 2:00 p.m. EST on Monday November 26, 2007 to discuss Textainer’s fiscal third quarter and nine month results. An archive of the Webcast will be available one hour after the live call through Friday December 14, 2007. The dial-in number for the conference call is 1-913-312-0661; outside the U.S. call 1-888-211-9994. To access the live Webcast or archive, please visit the Company’s website at http://www.textainer.com.

About Textainer Group Holdings Limited

Textainer has operated since 1979 and is the world’s largest lessor of intermodal containers based on fleet size. We have a total of more than 1.3 million containers, representing over 2,000,000 twenty-foot equivalent units (TEU), in our owned and managed fleet. We lease containers to more than 300 shipping lines and other lessees. We principally lease dry freight containers, which are by far the most common of the three principal types of intermodal containers. We have also been one of the largest purchasers of new containers among container lessors over the last 12 years. We believe we are also one of the largest sellers of used containers, having sold an average of more than 45,000 containers per year for the last five years. We provide our services worldwide via a network of 14 regional and area offices and over 300 independent depots in more than 130 locations.

Important Cautionary Information Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of U.S. securities laws. Forward-looking statements include statements that are not statements of historical facts and include, without limitation, statements that (1) the gain on disposal due to the reported loss by the U.S. military of approximately 28,000 containers is not expected to be a recurring item, (2) Textainer is on track to purchase more than the 132,600 TEU of new containers we have already ordered, (3) November and December are expected to be quite strong and (4) 2007 could become Textainer’s largest year in terms of originating Long Term leases. Readers are cautioned that these forward-looking statements involve risks and uncertainties, are only predictions and may differ materially from actual future events or results. These risks and uncertainties include that gains and losses associated with the disposition of equipment may fluctuate; Textainer’s ability to finance continued purchase of containers; the demand for leased containers depends on many political and economic factors beyond Textainer’s control; lease and freight rates may decline; the demand for leased containers is partially tied to international trade; Textainer faces extensive competition in the container leasing industry; and the international nature of the container shipping industry exposes Textainer to numerous risks. For a discussion of such risks and uncertainties, see “Risk Factors” in the Company’s final prospectus relating to the Company’s initial public offering dated October 9, 2007 and filed with the Securities and Exchange Commission on October 11, 2007.

The Company’s views, estimates, plans and outlook as described within this document may change subsequent to the release of this statement. The Company is under no obligation to modify or update any or all of the statements it has made herein despite any subsequent changes the Company may make in its views, estimates, plans or outlook for the future.

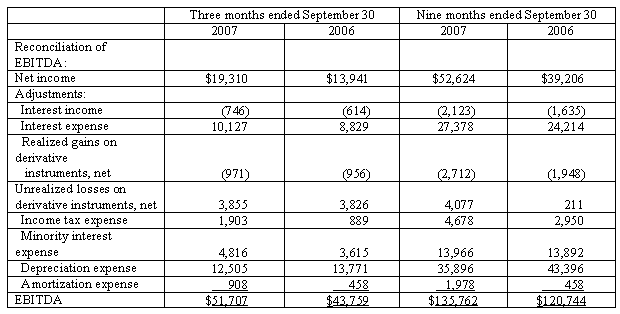

Non-GAAP Reconciliation of Net Income to EBITDA

Three and Nine Months Ended September 30, 2007 and 2006

(Unaudited)

(All currency expressed in United States dollars in thousands, except per share amounts)

The following is a reconciliation of net income to EBITDA for the three and nine months ended September 30, 2007 and 2006. EBITDA (defined as net income, before interest income and interest expense, realized and unrealized (gains) losses on derivative instruments, net, income tax expense, minority interest expense and depreciation and amortization expense) is not a financial measure calculated in accordance with U.S. generally accepted accounting principles (“GAAP”) and should not be considered as an alternative to net income, income from operations or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity. EBITDA is presented solely as a supplemental disclosure because management believes that it may be a useful performance measure that is widely used within our industry. EBITDA is not calculated in the same manner by all companies and, accordingly, may not be an appropriate measure for comparison. We believe EBITDA provides useful information on our earnings from ongoing operations, on our ability to service our long-term debt and other fixed obligations, and on our ability to fund our continued growth with internally generated funds. EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our operating results or cash flows as reported under GAAP. Some of these limitations are:

- It does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

- It does not reflect changes in, or cash requirements for, our working capital needs;

- It does not reflect interest expense or cash requirements necessary to service interest or principal payments on our debt;

- Although depreciation is a non-cash charge, the assets being depreciated may be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements;

- It is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; and

- Other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures.

CONTACT: Textainer Group Holdings Limited

Mr. Tom Gallo

Corporate Compliance Officer

415-658-8227

ir@textainer.com

Source: Textainer Group Holdings Limited